USD Bitcoin Debit Card Providers (Plastic and Virtual)

Bitcoin debit cards are a perfect choice for those, who want to be close to both their fiat money and bitcoins at the same time. The virtual and plastic cards work as an ordinary prepaid card, once the funds are loaded to the card balance, the bitcoin cards can be used to purchase goods and services at online shops or at local stores. You can even withdraw money from ATMs with the plastic bitcoin credit cards.

The account associated with the bitcoin card can be funded with USD or bitcoins amount. There are multiple top up option available at each debit card provider, beside transferring bitcoins, credit cards and bank wire are also among the acceptable top up methods. Several debit card provider also accepts such alternative payment processors as Neteller or Skrill e-wallets.

Ordering the card

The USD bitcoin card can be ordered through the provider’s platform after a quick registration process. Cardholders are requested to show a photo identification card along with a proof of residence, that could be a recent telephone bill for example. In case users don’t want to go through the registration process, there is an option to order anonymous bitcoin credit cards. With these bitcoin cards, clients don’t need to go through the process of verifying the account, however in this case certain card limits are applicable.

The issuance fee for a USD plastic bitcoin card is about 5-25 USD. The fee is only payable one time when the card is produced. Virtual bitcoin credit cards don’t have this production costs and issued instantaneously after providing the registration details.

The shipping of the card takes usually about 2-3 weeks after placing the order. The standard shipping cost is usually free. For an extra charge, users can order a card with a faster express shipping including the tracking number. In this case the cards are delivered with DHL within a couple of days worldwide.

Using The USD Bitcoin Card

After receiving and activating the bitcoin cards, both the virtual and the plastic credit cards can be used right away with the funds available on the card balance. USD bitcoin cards are accepted at online stores and local shops where the merchant is signed up for Mastercard or Visa payment methods. The plastic bitcoin card can be also used to withdraw money from ATMs both domestically and internationally.

There is also a monthly account maintence fee of 1 USD that is charged after activating the card. Funding the account can be free of charge if the cardholder select the playment method preferred by the card provider. Otherwise there is a 0.5-2% transaction fee applicable on funding the USD bitcoin card. The withdrawals are charged in a similar manner. The default currency of the account can be selected in most cases and USD currency is an available option at any card provider. In case the currency of the transaction does not match with the default currency of the account, an addition 3% currency translation fee is charged as well, so it worth considering the default currency before spending money abroad.

Users can top up the USD bitcoin card up to 20000 USD if the account is verified. The cash withdrawl limit is in most cases maximized at 2000 USD. The limits of the anonymous cards are lower significantly compared to the ones available for verified users.

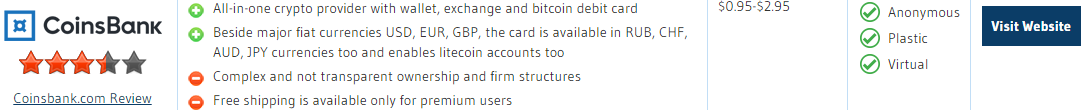

Pros and cons

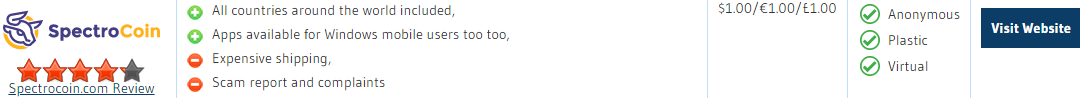

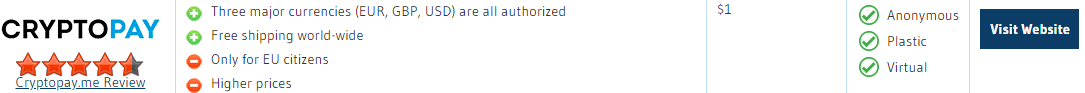

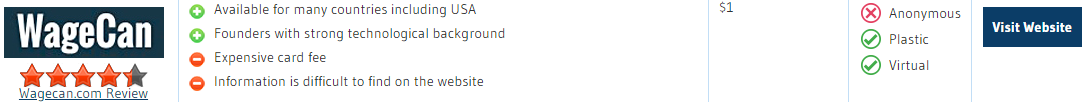

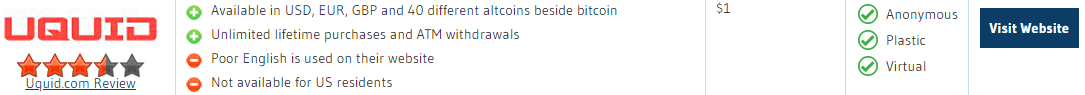

USD bitcoin cards are a good solution for those who want to spend fiat currency or bitcoins in an easy and fast manner. All of the debit card providers let cardholders to choose USD as a currency. The fees, limits and the features of the bitcoin credit cards ranges wide but everyone will find a product on the market that suits their needs the best.