![]()

Virtual Bitcoin Debit Cards

The virtual bitcoin debit card offers all the same benefits of the plastic debit card just without the risk of loss, damage and long delivery time. These virtual cards works just like any other debit card, the amount of money can be used at shops to purchase goods and services online.

Ordering the card

If you want to obtain a virtual bitcoin debit card, you need to verify your identity in most cases with an ID card and a bill showing your residential address. But there are also anonymous cards available on the market, where the only information that should be given is your name that will be displayed on the cards.

The virtual bitcoin cards are much cheaper than the plastic cards. Because there is no production cost, there are even providers who give you a virtual card for free. Otherwise a virtual bitcoin debit card cost around 1 to 5 USD.

Once the registration have been completed, the virtual card is sent directly to the user via e-mail. The card have a card holder name, a CVV/CVC on the back and an expiration date just like any other plastic debit card. With this information the users can start using the card right away online.

Using the card

The virtual debit cards are issued by VISA or Mastercard, therefore they are accepted at shops worldwide and in online stores. There is no difference in providing the details of an ordinary plastic card or a virtual card upon checkout at the shops.

The virtual bitcoin debit card cannot be used to withdraw money from ATMs. Since no physical card is produced, there is no way to have a transaction at a shop which accepts ATMs or debit card to receive cash. Most of the card providers developed apps for mobile devices, so the card can be still used on the go from iOS or Android phones.

There are certain limits applicable for using the virtual bitcoin cards. The total turnover of the cards is limited to 500 USD to 10000 USD and depends on the card provider. The spending is charged on the card, especially if the currency is a different one compared to the default currency of the card.

Pros and Cons

The virtual bitcoin debit card is a perfect choice for those who want to spend their bitcoins online. The card have all the same benefits as a plastics card and is accepted by retailers online who accept VISA or Mastercard as payment method. The one time issuance fees is also much cheaper compared to the charge for a plastic card. There is also no delivery time, you can use the card right away after order.

The only negative thing about virtual bitcoin debit cards is that there is no physical card. The virtual cards cannot be used to pay at local shops or to withdraw cash from ATMs.

These providers offer virtual cards:

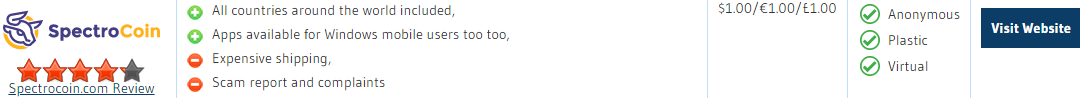

– SpectroCoin Card Virtual

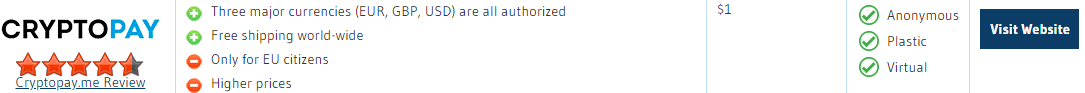

– Cryptopay Card Virtual

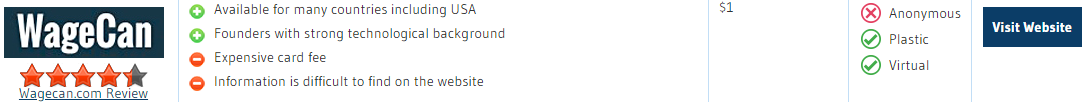

– WageCan Card Virtual

– Advcash Card Virtual

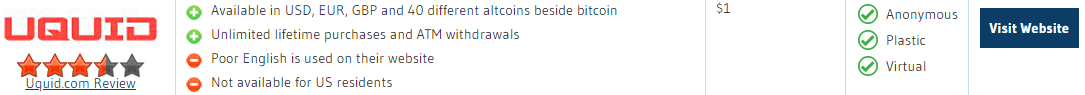

– Uquid Card Virtual

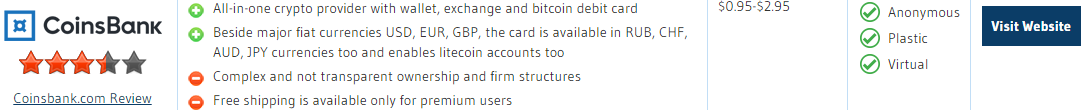

– Coinsbank Card Virtual

Virtual Bitcoin Card