Plastic Bitcoin Debit Cards

The plastic bitcoin debit card is a very useful tool for those who would like to have an easy access to their bitcoins. The card looks and works the same way like any other prepaid debit card, the cardholder can use the balance on the card to pay at shops, purchase online or withdraw money from ATMs.

Ordering Card

The plastic bitcoin debit card is offered by different bitcoin card providers. The card costs around 5-20 USD for ordering, beside the monthly account maintence fee.

During the registration process the card providers asks for your personal details to verify you identity. But there are also anonymous cards available, in which case only a name should be given that will be displayed in the card. A couple of providers also offering company cards to distinct the spending of the business from the personal transactions.

You can choose from two types of delivery methods: standard and express. The standard shipping takes about 2-3 weeks to arrive, depending on your location and is usually free. The express shipping takes just a couple of days but they charge an extra fee.

Using the card

The plastic bitcoin debit cards are issued by VISA or Mastercard thus these are accepted at any shops or online retails where these logos are also displayed. You also have the option to withdraw cash from ATMs worldwide, just like any other plastic debit card. The plastic bitcoin debit card have a name, an expiration date and a CVV/CVC code on the back of the card.

There are certain limits applicable for the card, these limits are bases on the level of verification – unverified users have a lower amount of funds. The daily limits vary from 500 USD to 1000 USD, while there are also bitcoin cards with an unlimited balance, available for a higher annual fee.

The turnover of the bitcoin cards are charged depending on the transaction type, domestic card usage from 0.5% while international spendings from 1.5%. A currency translation fee is applied in case the amount spent is in a different currency compared to the card’s default currency.

Pros and Cons

The plastic bitcoin debit card is a great choice for those who would like to have a quick and easy to their bitcoins everywhere at anytime. The cards work just like normal debit card and are accepted at any shops where VISA or Mastercard is accepted.

The disadvantage of the plastic bitcoin cards can be that in most cases personal verification is required to get a card. Also an extra fee is applied for the production of the plastic card. The shipping can be even a month if you don’t pay extra fee for express delivery.

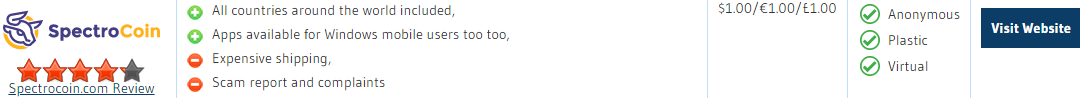

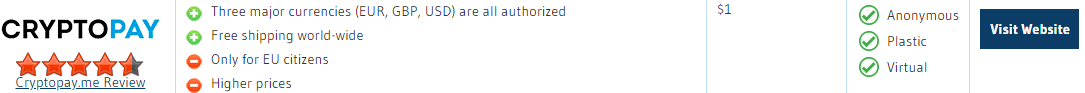

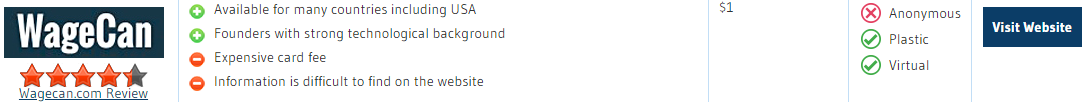

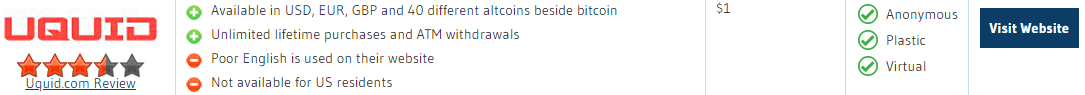

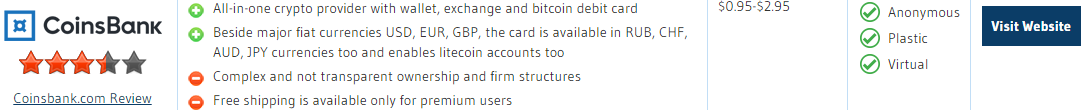

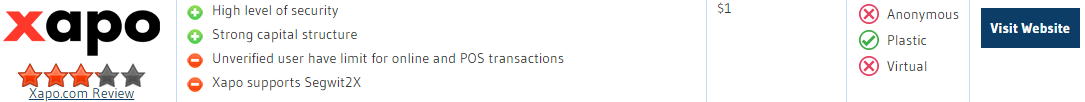

These providers offer plastic cards: